By Edmond Ortiz

According to some San Antonio officials, an increase to the city’s property tax rate might be needed to support the city’s next potential bond issuance before the end of this decade.

What you should know.

City Council was briefed by top city staff Jan. 21 on the city’s next bond cycle, where the local 2027 election season could be the target date to have a bond election.

City officials said, because the local government has had a five-year bond package cycle and the last bond election was held in 2022, it would be wise to start preparing for a potential vote on an issuance in 2027.

The Jan. 21 briefing was, overall, a look at the city’s debt program. According to city staff, San Antonio currently has $500 million in present bonding capacity, and $2.6 billion in outstanding ad valorem debt.

While recent bond issuances have received voter approval based upon the city not requiring a property tax rate increase, city officials said the next bond election may include a hike on the total city tax rate, something that has not happened in more than 30 years.

No decision has been made yet, but city staff broke down the numbers for council members: Elected leaders have the discretion to raise the city’s daily general operations property tax rate a maximum of 3.5%, a number that is capped by state law. A higher increase would need voter approval. San Antonio’s debt service tax rate has stood at 21.1 cents per $100 valuation since 2003.

San Antonio’s total taxable assessed value stands at $160 million and is estimated to rise another 2.5% through 2030. City officials suggested keeping the debt service tax rate at 21.1 cents, but allowing enough flexibility to adjust that rate depending on the annual growth rate of taxable values. The yearly average growth rate of taxable values stands at 6.33% over the past 22 years.

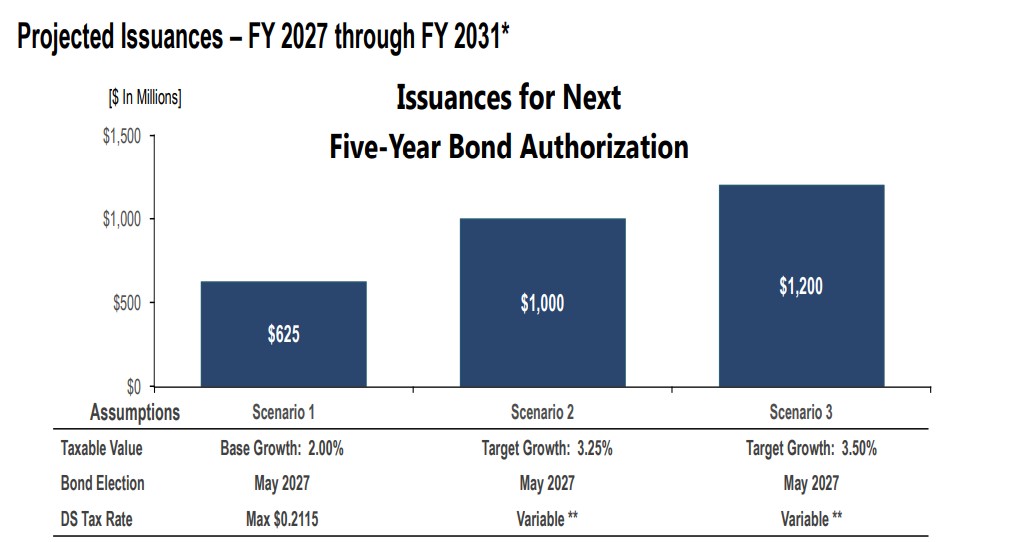

City staff laid out three scenarios. One scenario, featuring a May 2027 bond election, would provide $625 million in bonding capacity based on little more than 2% average taxable value growth.

A second scenario would provide $1 billion of bonding capacity based on 3.25% growth; a third scenario would permit a $1.25 billion bond based on 3.50% growth. City staffers said if the average growth number turns out to be less than 3.25% in either scenario No. 2 or 3, a property tax hike could be needed to make up for that lower value growth.

City officials are also looking at monthly stormwater fees, which are based on the amount of impervious cover on a resident or commercial/industrial ratepayer’s property. Revenues of such fees help to fund stormwater capital improvement projects within the annual fiscal year budget.

The city currently has $24.5 million in outstanding stormwater rate debt; the city last increased such rates in 2020. City staff offered three scenarios that envision incrementally raising stormwater fees anywhere from 10% to 16.20% over a five-year period, starting in Fiscal Year 2027.

According to city officials, if any of those scenarios are implemented, the annual rate increase on the average residential stormwater ratepayer would range from $1.20 to $10.08.

Depending on whether a bond election takes place in May or November 2027, the city has a preliminary 2027 bond election calendar that calls for identifying potential projects, and engaging street and drainage advisory boards and community members over the rest of this winter and summer.

Estimating of potential project costs could begin as early as spring 2026 or winter 2027. More council and public discussion on bond projects would follow in fall 2026 or winter 2027 leading up the council calling a May or November election next year.

Another factor in council discussions is how to address proposed infrastructure improvements around the site of the future San Antonio Spurs downtown arena, and whether those upgrades should be included in a larger, citywide bond package or offered as a separate ballot item.

What they are saying

Many council members favored scenarios that leave the door open for an increased property tax rate to help fund a future bond, and higher stormwater fees to support related capital improvements.

But some leaders acknowledged that asking voters to mull such hikes could be difficult given economic uncertainty, slow growth in jobs and wages, inflation, and the San Antonio Water System’s planned consideration of water service rate increases.

District 6 City Councilmember Ric Galvan said he would rather have the money available in 2027 to begin to immediately tackle what he called overdue road and drainage improvements in his district.

Galvan also suggested city staff develop a scenario where the city could increase, if needed, only non-residential stormwater rates, and not touch residential fees.

“Years of traffic-related deaths on (Culebra, Grissom, Marbach, Callahan, New Guilbeau and Sunrise roads) Is simply too long to say that we know these streets are dangerous,” Galvan said. “We know what the improvements could be. We can’t keep waiting for $100,000 in funding to hopefully improve it. We need big changes on some of these major roads, including the ones in my district.”

District 10 City Councilmember Marc Whyte said he is concerned that raising the property tax rate and significantly increasing stormwater fees could adversely affect many residents.

Whyte added that aside from possible SAWS rate hikes, CPS Energy and the city’s solid waste collection departments may also require rate increases down the road. He also suggested that city staff find ways to more efficiently address major infrastructure projects within the city’s annual fiscal year budgeting process, so that local officials will rely less on a bond to take care of such initiatives.

“What’s the number where we’ll say it’s too much?” Whyte said. “Somehow other mayors and other city councils have made it the last 22 years without touching the (debt service) tax rate. They had needs. They wanted to spend money on infrastructure. Somehow, we haven’t had to do it, but now we need the money so badly that we’ve got to do it.”